Wages after taxes

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Get an accurate picture of the employees gross pay.

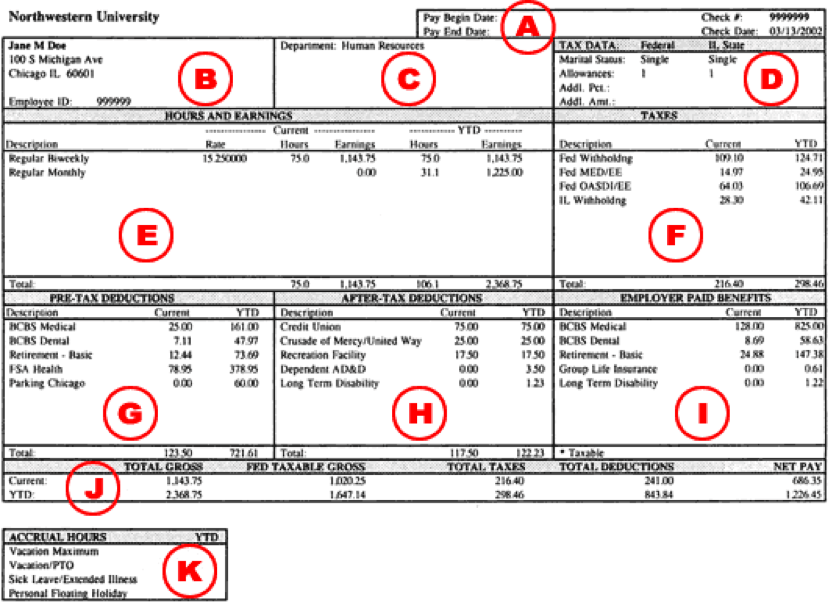

Understanding Your Paycheck Human Resources Northwestern University

Given you file as a single taxpayer you will only pay federal taxes.

. For example if an employee earns 1500. Check your tax code - you may be owed 1000s. 1 day agoThe votes all came after she was cited by the state for failing to pay her own taxes according to a review of legal and legislative records.

It can be any hourly weekly or annual before tax income. All wages salaries and tips you received for performing services as an employee of an employer must be included in your gross income. If this income was not included in the final.

Thus 412000 annually will net you 282562. 11 income tax and related need-to-knows. If the IRS levies seizes your wages part of your wages will be sent to the IRS each pay period until.

If youre employed then recall that federal taxes have. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. President Joe Biden announced the plan last week that would.

Federal tax which is the money youre paying to the Canadian government. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. If your weekly disposable income is 290 or more 25 is taken.

If your salary is 40000 then after tax and national insurance you will be left with 30879. The money for these accounts comes out of your wages after income tax has already been applied. IRD is income that would have been included in the deceaseds tax returns had they not passed away.

Information About Wage Levies. This places Ireland on the 8th place in the International. Discover Helpful Information And Resources On Taxes From AARP.

Your average tax rate is. KiwiSaver knumber optional The percentage you contribute. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

This means that after tax you will take home 2573 every month or 594 per week. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. 1 day agoAn executor of an estate.

This places US on the 4th place out of 72 countries in the. 2 days agoA handful of states have indicated that they may count the canceled debt as income and apply state taxes to it. In March 2009.

Rates remain high in Melbourne where median weekly earnings top 1200. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. This means you pay 12943850 in taxes on an annual salary.

Welcome to welfare state. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. See where that hard-earned money goes - Federal Income Tax Social Security and.

That means that your net pay will be 40568 per year or 3381 per month. After deducting taxes the average single worker in Sydney takes home 53811 yearly or 4484 per month. In the United States the Fair Labor.

Free tax code calculator. How to calculate annual income. If youre making less than 30k a year youll probably keep about 80 after federal and state tax plus all the other ones.

If its 217. Minimum Wage Us After Taxes - Base pay is the minimum per hour rate of rate made to employees also referred to as the pay floor. If you earn 40k a year in California you would.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. The reason to use one of these accounts instead of an account taking pre-tax money.

401 Wages and Salaries. Income qnumber required This is required for the link to work. Federal Salary Paycheck Calculator.

Try out the take-home calculator choose the 202223 tax year and see how it affects. Transfer unused allowance to your spouse. You make other arrangements to pay your.

It starts at a 15 rate and rises with your income up to 33. Heres how that breaks down. If its between 28999 and 21751 the amount above 21751 can be taken.

How To Calculate Your Net Salary In The Netherlands Undutchables

Paycheck Calculator Take Home Pay Calculator

50 000 After Tax 2021 Income Tax Uk

Paycheck Calculator Take Home Pay Calculator

Taxes And Social Security Leiden University

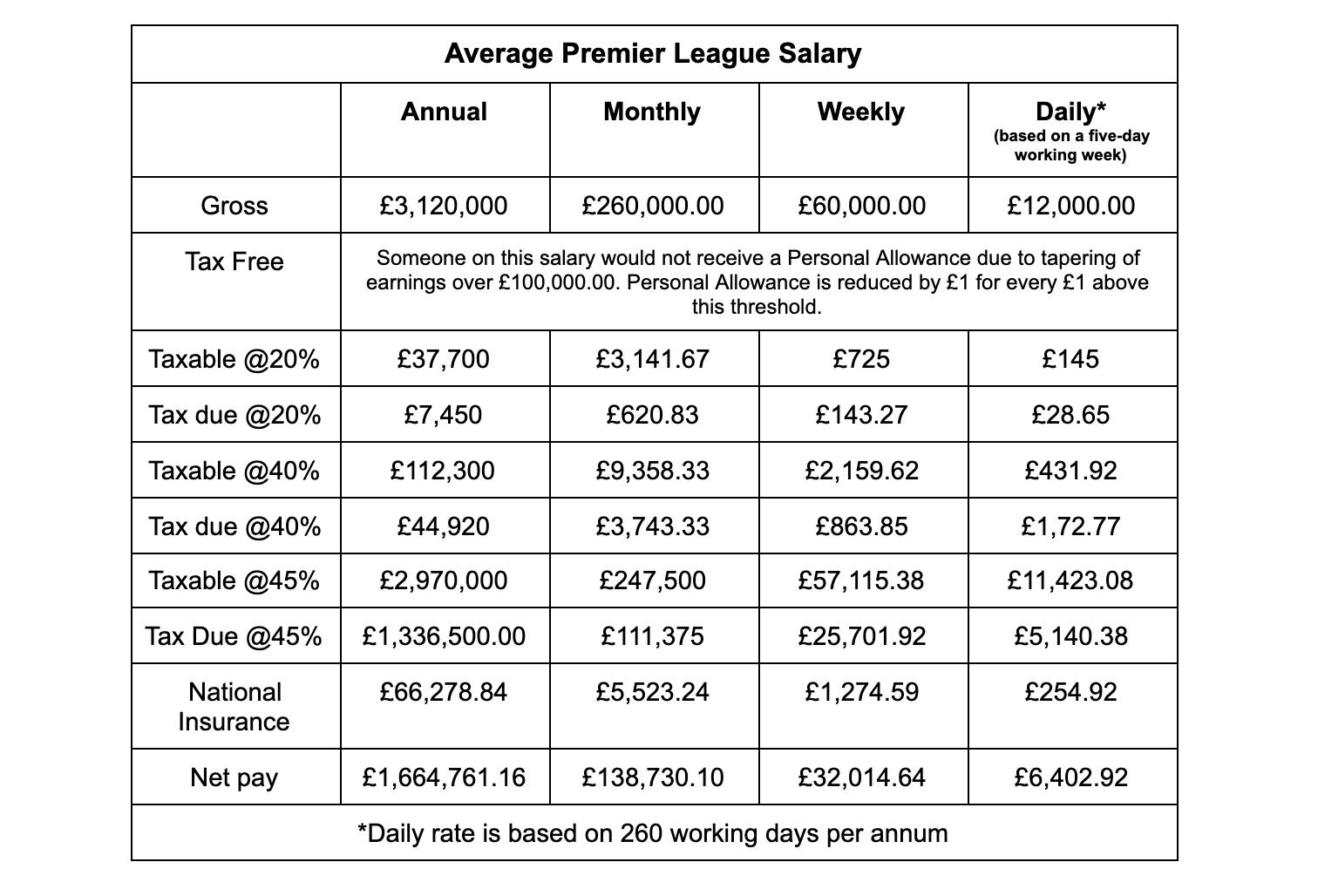

How Much Tax Does A Premier League Footballer Pay

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

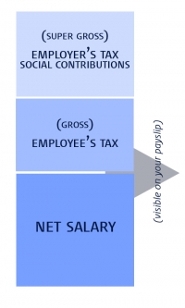

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Are Earnings After Tax Bdc Ca

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Are Payroll Taxes And Who Pays Them Tax Foundation

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Payroll Taxes Methods Examples More